[ad_1]

(Bloomberg) — US inflation probably moderated at the end of the third quarter, reassuring a Federal Reserve that’s shifting more of its policy focus toward shielding the labor market.

Most Read from Bloomberg

The consumer price index is seen rising 0.1% in September, its smallest gain in three months. Compared with a year earlier, the CPI probably rose 2.3%, the sixth-straight slowdown and the tamest since early 2021. The Bureau of Labor Statistics will issue its CPI report on Thursday.

The gauge excluding the volatile food and energy categories, which provides a better view of underlying inflation, is projected to rise 0.2% from a month earlier and 3.2% from September 2023.

In the wake of surprisingly strong job growth for September reported on Friday, the gradual slowdown in inflation suggests policymakers will opt for a smaller interest-rate cut when they next meet on Nov. 6-7.

Fed Chair Jerome Powell has said projections issued by officials alongside their September rate decision point toward quarter-point rate cuts at the final two meetings of the year.

The CPI and producer price index are used to inform the Fed’s preferred inflation measure, the personal consumer expenditures price index, which is set for release later this month.

What Bloomberg Economics Says:

“We expect a subdued headline CPI in September, though a more robust core reading. Mapped into PCE inflation — the Fed-preferred price gauge — core inflation likely grew at a pace consistent with the 2% target. Altogether, we don’t think the report will do much to sway the FOMC’s confidence that inflation is on a durable downtrend.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For full analysis, click here

Friday’s report on producer prices — a gauge of inflationary pressures faced by businesses — is also projected to show tamer inflation. The same day, the University of Michigan issues its preliminary October consumer sentiment index. The Fed will also release minutes of the central bank’s September meeting on Wednesday.

Neel Kashkari, Alberto Musalem, Adriana Kugler, Raphael Bostic and Lorie Logan are among an array of Fed officials speaking in the coming week.

In Canada, officials will release the final jobs report before the next Bank of Canada rate decision, a crucial input for Governor Tiff Macklem, who expects to see further loosening of the labor market. The central bank will also publish surveys of business and consumer expectations for economic growth and inflation.

Elsewhere, central banks from New Zealand to South Korea may cut rates, France will reveal its budget, and the European Central Bank will publish minutes of its September policy meeting.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Asia

It’s a big week for monetary policy in Asia, with two central banks likely to cut rates and another inching closer to doing so.

The Reserve Bank of New Zealand is expected to follow its August pivot to an easing cycle by trimming rates by a half percentage point, to 4.75%, when the board meets on Wednesday, as weakness in payroll data kindles labor market concerns.

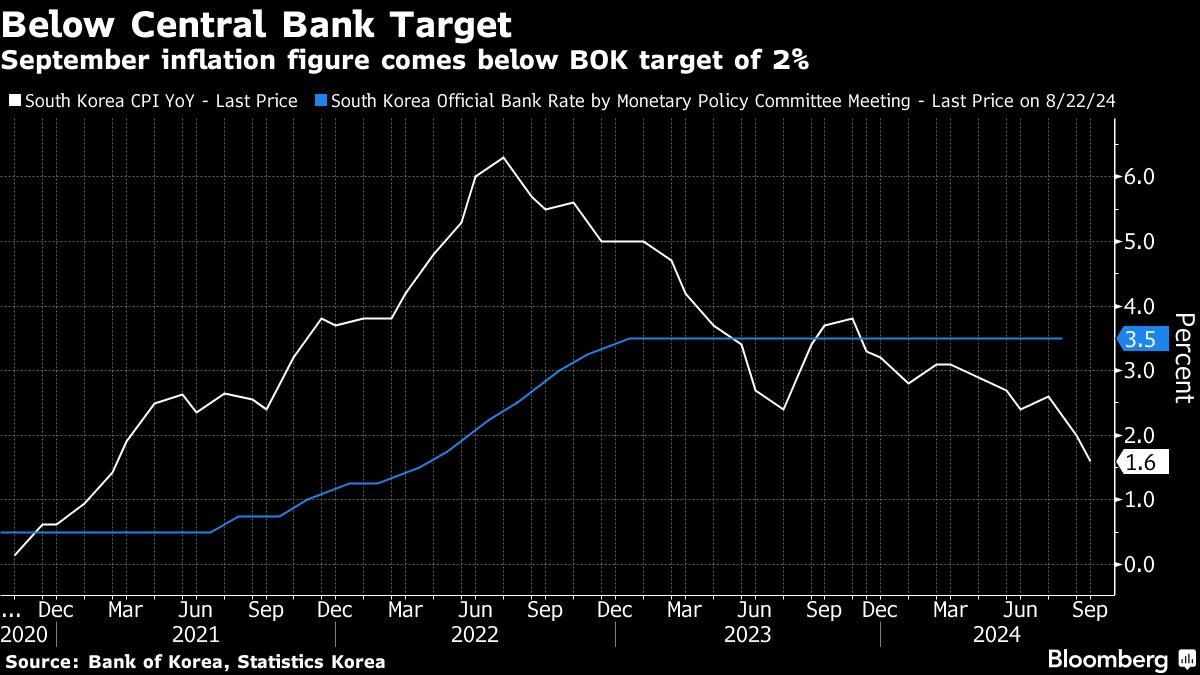

The Bank of Korea will probably trim its benchmark by a quarter point on Friday after inflation decelerated to the slowest pace in more than three years, with the decision hinging on whether conditions in the housing market have cooled enough.

The Reserve Bank of India is seen holding its repurchase rate and cash reserve ratio steady, with many economists looking for a quarter-point cut to the repo rate by year-end. And Kazakhstan’s central bank will decide on Friday whether to resume its easing campaign.

On Tuesday, the Reserve Bank of Australia releases minutes from its September meeting that may shed light on the deliberations that led to its hawkish hold, and the RBA’s No. 2, Andrew Hauser, speaks the same day.

Japan gets wage statistics and household spending data, both of which are of interest to the newly installed government ahead of a general election at the end of the month.

Singapore is set to report third-quarter gross domestic product some time between Thursday and Monday — with the consensus estimate looking for an acceleration of growth year on year.

Data published Sunday showed that Vietnam’s economic growth unexpectedly accelerated last quarter, boosted by manufacturing and exports before a super typhoon in September caused widespread damage and halted farm and factory output.

Consumer inflation data are due from Thailand and Taiwan, while the Philippines and Taiwan publish trade figures.

Europe, Middle East, Africa

Germany’s manufacturing woes will be in focus with the release of factory orders on Monday and industrial production on Tuesday, followed by government economic forecasts on Wednesday.

Officials are poised to abandon hope of achieving any expansion at all this year, according to people familiar with the matter. Sueddeutsche Zeitung reported over the weekend that Berlin now expects a 0.2% contraction for 2024.

In France, Prime Minister Michel Barnier’s government is set to present its 2025 budget bill on Thursday, at a time when the country is struggling to tame its deficit. Fitch Ratings has scheduled the possible release of an assessment on the country for after the market close on Friday.

For the European Central Bank, Wednesday is the final day for officials to speak publicly on monetary policy before a blackout period kicks in ahead of the Oct. 17 decision, at which a rate cut seems a near certainty.

Chief economist Philip Lane, Bundesbank President Joachim Nagel, and Bank of France Governor Francois Villeroy de Galhau are among those scheduled to make appearances. An account of the previous meeting will be published on Thursday, providing possible clues on the upcoming judgment.

In the UK, meanwhile, in the wake of remarks by Bank of England Governor Andrew Bailey that opened the door to more aggressive easing, GDP data on Friday will point to the health of the economy in August.

Two Riksbank officials are scheduled to speak after the Swedish central bank delivered a third rate cut in September. Sweden’s monthly growth indicator will be published on Thursday.

Turning south, authorities in Egypt will hope inflation resumed its slowdown in September after a slight acceleration the prior month. The last reading was 26%, slightly below the central bank’s base rate of 27.25%.

Three central bank decisions are scheduled around the region:

-

On Tuesday, Kenya’s monetary policy committee is set to reduce its key rate for a second straight meeting by a quarter point, to 12.25%. Inflation is expected to remain below its 5% target in the near term after slowing to a 12-year low in September.

-

On Wednesday, Israeli officials are likely to keep their rate on hold again at 4.5%, even as peers start or continue easing cycles. The war against Hamas in Gaza and escalating conflicts with Hezbollah and Iran are weighing on the shekel, which is near a two-month low. The country’s credit rating was recently cut by Moody’s and S&P.

-

Serbia’s central bank makes its monthly decision on Thursday, possibly continuing with monetary easing after a quarter-point cut in September.

Latin America

By the end of the week, third-quarter consumer price data for all five of Latin America’s big inflation-targeting economies will be in the books.

Lower readings can be expected in Chile, Colombia and Mexico, while the unmistakable heating up of Brazil’s economy and prices likely continued in September. All four central banks target inflation of 3%.

In Brazil, aside from the central bank’s expectations survey posted Monday, the August retail sale report may show a slight cooling from what’s been a brisk set of 2024 readings.

The minutes of Banxico’s Sept. 26 meeting will be the highlight out of Mexico. Policymakers sounded a dovish tone in their post-decision statement’s forward guidance after a second-straight 25 basis point rate cut to 10.5%.

In Peru, September’s month-on-month deflation and a below-target 1.78% annual print likely greenlights a third straight central bank rate reduction from the current 5.25%.

After rapidly reining in overheated consumer price increases, Argentine President Javier Milei’s inflation fight appears stalled, with successive monthly prints near 4%. Economists surveyed by the central bank see modest slowing ahead under the current policy mix.

–With assistance from Robert Jameson, Laura Dhillon Kane, Piotr Skolimowski, Monique Vanek and Paul Wallace.

(Updates with Germany in EMEA section)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

[ad_2]

Source link

Share this content: