[ad_1]

Outlook

The markets chose to interpret the labor market data last week as validating the Fed’s claim to a soft landing. Stocks, yields and the dollar went up.

This interpretation is a choice. The market could just as easily have said the labor shortage is still visible and the economy is too hot, no cut at all in November. Apparently moving down from 50 bp to 25 bp was tiring enough and nobody wanted to go that far. Well, a few. Those predicting no rate cut in November went from zero a week ago to 12.7% by this morning, according to the CME FedWatch.

The Fed gets one more payrolls report before the Nov policy meeting and another high number could spell the hangman for any rate cut at all.

Then there’s inflation. Because of mixed readings and inadequate reporting, we can’t be sure the US is getting wage—push inflation, but it’s no help that average hourly earnings rose 4%, too.

The Fed prefers the PCE and doesn’t heed CPI but the market does. If labor is okay and CPI not falling, we need to worry about getting even 25%. That’s where the minutes might come in. The minutes get parsed for any and every tiny change, but it’s not really necessary—just remember member Bowman disagreeing with 50 bp because inflation has not yet proved itself.

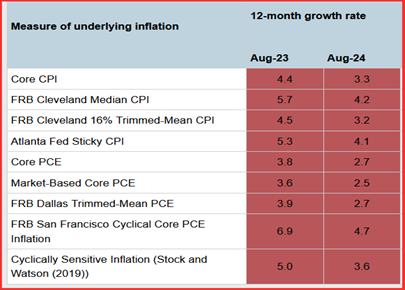

The table here is from the Atlanta Fed’s “underlying inflation dashboard”. Its own sticky inflation is 4.1%. The Cleveland Fed trimmed mean has 3.2%. Golly, maybe we have been too sanguine about inflation having gotten whipped.

The BLS has 2.5% y/y in Aug and some sources say Sept is expected at 2.2-2.3%. Core is higher but likely at 25.%. (https://www.bls.gov/cpi/). Note that the drop in energy prices is a big contributor and that’s at risk now.

Net-net, there is a real chance the inflation data disappoints… and remember, the Fed has not actually promised rate cuts, just indicated them as likely if the data cooperates. We give the probability of no cut in November as 10-20%, but that can change.

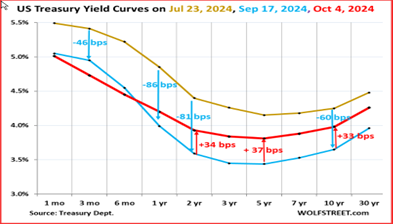

The bond market bought into the endless rate cut narrative only for a short while. See the chart from WolfStreet. Maybe the bond market is also skeptical about the extent of cuts. Wolfs writes “The 10-year yield isn’t as much a reflection of rate cuts and rate-cut expectations, which impact short-term yields, but more a reflection of inflation expectations over the next 10 years. And there are all kinds of dynamics under way now that indicate that inflation might not go back to sleep. We got the latest indication in the jobs report: steep increases of average hourly earnings in August and September.”

Forecast

We are no longer alone in wondering if the chance of no rate cut in November is not zero. Meanwhile, the probability of an ECB rate cut in just 10 days is nearly 100, and so far it looks like Japan is willing to wait indefinitely to normalize rates. Coupled with other increases in risk—the Middle East, oil prices—the dollar is on a more lasting upswing. We will get another Atlanta GDPNow estimate for Q3 tomorrow, which will likely validate the idea of the US economy more robust and resilient than anybody else.

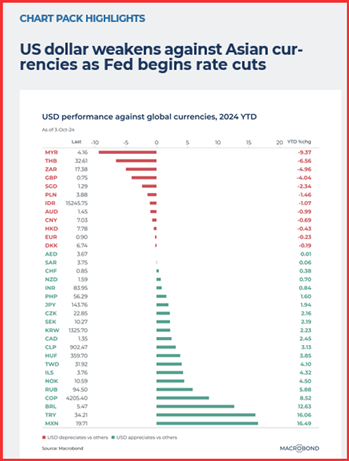

Tidbit: The table of world currencies is from Macrobnd.com. It shows emerging market currencies, especial Asians, doing super-well against the dollar. “As the Fed continues its dovish policy, the USD may face further downward pressure.”

Well, yes and no. The yield differential is a top factor in currency determination, but not the only one–and also given “all other things equal,” the economist’s touchstone and excuse. When it comes to emerging markets, all other things are definitely not equal. The US 3-month Treasury yields 4.5%. The Mexican version is 10.5%. Now look where the peso lies—at the bottom of the list.

A puzzle: the Asian economics are running big trade surpluses. They have been pilfering business from China. Traditional economics would infer that the persistence of surpluses means the currency is undervalued. Whence the demand for the local currencies? One factor might be foreigners buying imports and hoarding the local currency. It might be foreigners buying the local currency to buy into the local stock markets or even direct investment. It could be capital flight from neighbors. But honestly, we don’t know.

As for the other-things-not-equal, there’s government competence or crookedness, crime (think Mexican kidnapping and cartels), institutional mismanagement (Turkish central bank), skill and educational level of the citizens, vulnerability to Mother Nature, and a slew of other factors that are hard to measure and therefore hard to compare.

When a crisis of just about any sort hits, especially if it pertains to foreigners holding local assets, they are first out the door. It pays to remember the Long-Term Capital debacle.

Political Tidbit: As of Sunday afternoon, the Silver Bulletin had Harris ahead with 49.3% vs. 46.2% for Trump. Again, not the electoral college and not the swing states. Trump is shooting himself in the foot by abandoning the traditional Republican fiscal rectitude (which has historically been more rhetorical than actual). Something named the Committee for a Responsible Federal Budget, a Washington non-partisan group, issued a report showing the US debt up by $7.5 trillion if Trump wins. In contrast, the Harris plan would raise the debt by $3.5 trillion.

Then there’s the Republicans appearing on Sunday TV and refusing to say Trump lost the 2020 election. Ther is no doubt he will contest the Nov 5 election, assuming he loses. Even the president says “free and fair” but not likely peaceful. It’s hard not to see those supporting Trump as ignorant and/or befuddled.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

[ad_2]

Source link

Share this content: