[ad_1]

(Bloomberg) — Equity markets gained on optimism about the health of the US economy and speculation that stimulus will finally kick-start growth in China.

Most Read from Bloomberg

Benchmarks advanced across Asia, and European futures pointed to a stronger open, following Friday’s US payroll data. Treasury 10-year yields rose to hover just shy of the key 4% threshold as investors trimmed bets on big Federal Reserve interest-rate cuts. The euro, pound and most Asian currencies weakened against the dollar.

Trading is being shaped by signs of resilience in the world’s largest economy after employers added the most US jobs in six months in September. Wagers on a “no landing” scenario — where US growth momentum remains intact and inflation reignites — stand to boost the greenback while triggering a drop in haven assets. A gauge of Chinese stocks in Hong Kong jumped to the highest level in more than two years before mainland markets reopen Tuesday after a week-long holiday.

Investors are “starting to reprice and rethink what the Fed’s doing,” said Jessica Zarzycki, a Nuveen Asset Management LLC bond fund manager. “They have enough room as inflation trends towards 2% to take out some of those emergency cuts that we saw.”

Chinese authorities have announced a number of stimulus measures over the past two weeks. Officials from the National Development and Reform Commission will hold a briefing on Tuesday on implementing incremental economic policies.

Goldman Sachs Group Inc. upgraded Chinese stocks to overweight, with strategists including Tim Moe citing a further 15%-to-20% upside potential even after the rally that started in late September. Still, there have been a number of false dawns already and firms such as Invesco Ltd., JPMorgan Asset Management, HSBC Global Private Banking and Wealth, and Nomura Holdings Inc. are among those viewing the rebound with skepticism.

Beijing will need to use its fiscal firepower to arrest the housing-market slump and also stimulate private consumption, which “depends on business confidence and animal spirits in the private sector,” said Qian Wang, chief economist for Asia Pacific at Vanguard Group Inc.

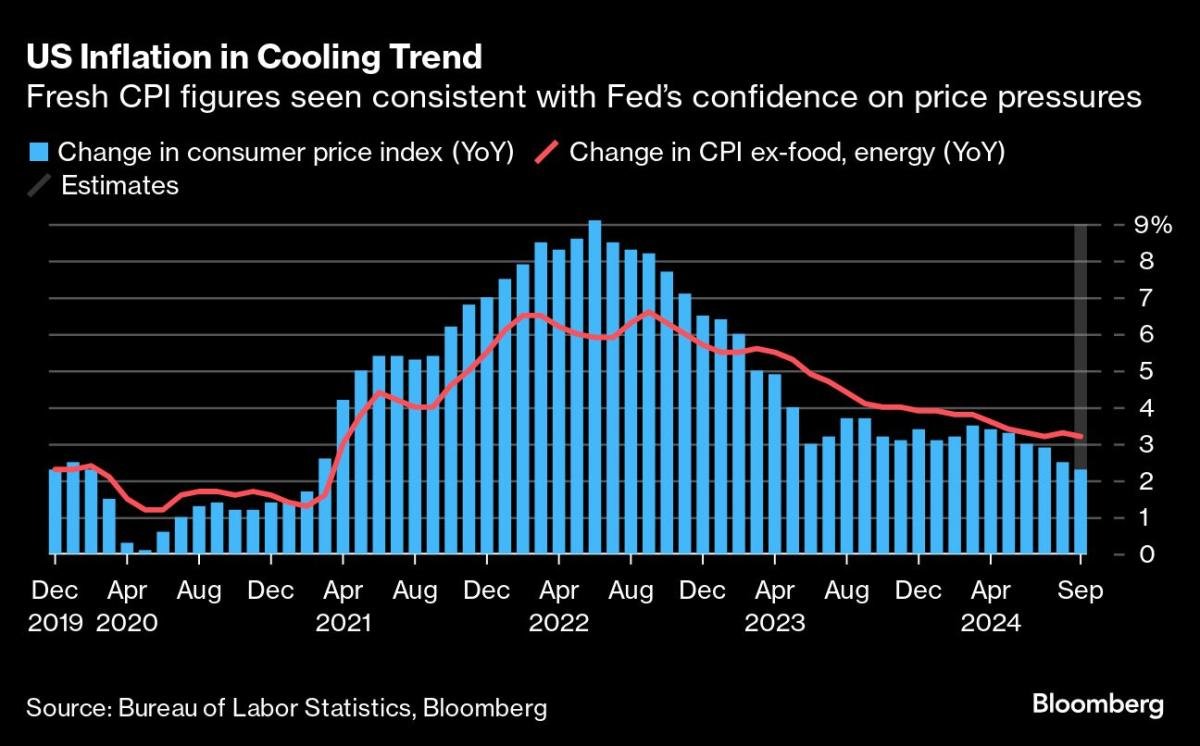

On the US agenda this week are minutes from the Fed’s September policy meeting, as well as consumer price data. US inflation probably moderated at the end of the third quarter, which suggests policymakers will opt for a smaller interest-rate cut when they next meet on Nov. 6-7.

US futures were pointing to a lower open, after the S&P 500 Index jumped 0.9% on Friday thanks to the stronger-than-expected jobs report.

Revised expectations for the Fed prompted a slide across emerging Asian currencies on Monday. Indonesia’s central bank said it’s ready to step in to support the rupiah, on course for a sixth day of declines.

New Zealand bonds fell less than Treasuries amid speculation the central bank will cut rates by 50 basis points on Wednesday.

South Korea and India are also due to decide on interest rates this week. Bloomberg Economics expects the 25-basis-point cut by the Bank of Korea on Friday as inflation slows and tighter regulations start cooling the housing market. The Reserve Bank of India is expected to strike a dovish tone at its meeting on Oct. 9, and may even lower interest rates.

Oil drifted lower as traders weighed Israel’s potential retaliation against Iran for a missile attack last week, with President Joe Biden discouraging a strike on Tehran’s crude fields.

Here are some key events this week:

-

Euro-area finance ministers meet in Luxembourg on Monday. ECB President Christine Lagarde will participate

-

Minneapolis Fed President Neel Kashkari, Atlanta Fed President Raphael Bostic, St. Louis Fed President Alberto Musalem and Fed Board member Michele Bowman speak at different events on Monday as investors listen for any clues to policymakers’ thinking ahead of next month’s meeting

-

Brazil and Mexico publish CPI data, New Zealand, Israel and India hold interest rate decisions

-

US CPI for September, the final inflation print before the presidential election, is due Thursday

-

President Biden embarks on a trip to Germany and Angola, through Oct. 15, his first trip abroad since withdrawing from the presidential race, on Thursday

-

New York Fed President John Williams gives keynote remarks at Binghamton University in New York. Richmond Fed President Thomas Barkin speaks in a fireside chat on the economic outlook on Thursday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.2% as of 2:35 p.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 2.6%

-

Japan’s Topix rose 2%

-

Hong Kong’s Hang Seng rose 1.1%

-

Euro Stoxx 50 futures rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0965

-

The Japanese yen rose 0.1% to 148.49 per dollar

-

The offshore yuan rose 0.1% to 7.0886 per dollar

Cryptocurrencies

-

Bitcoin rose 1.3% to $63,451.29

-

Ether rose 1.9% to $2,485.98

Bonds

Commodities

-

West Texas Intermediate crude fell 0.3% to $74.19 a barrel

-

Spot gold fell 0.4% to $2,643.57 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess and Tania Chen.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

[ad_2]

Source link

Share this content: